Recurring billing is growing fast, with the subscription economy projected to hit $1.5 trillion in 2025. For SaaS businesses, managing billing cycles and payments can get complicated, especially with different subscription types like monthly, annual, or usage-based plans. Standard systems often can't keep up, leading to errors, delays, and customer churn.

Custom payment workflows solve these challenges by automating processes like invoicing, payment retries, and subscription changes. They also improve failed payment recovery, reduce churn, and simplify complex billing scenarios. By integrating with tools like accounting software and payment providers, businesses can streamline operations, save time, and increase revenue.

Key Takeaways:

- Custom workflows handle complex billing needs: Monthly plans, usage-based charges, proration, and more.

- Automation reduces errors: Recover up to 56% of failed payments with tools like Stripe’s Smart Retries.

- Better customer retention: Use tailored recovery strategies, like temporary discounts or subscription pauses.

- Integration is critical: Choose payment providers with strong APIs and global payment support.

- Stay compliant: Automate tax calculations, PCI compliance, and revenue recognition.

Custom workflows aren't just about billing - they're about creating a smooth, efficient system that helps SaaS companies grow while keeping customers happy.

What Is Workflow Automation For SaaS Finance Operations? - All About SaaS Finance

Core Features of Custom Payment Workflows

Custom payment workflows revolve around three key components that work together to create a smooth and efficient billing experience. These features address recurring billing challenges and help drive SaaS growth by integrating seamlessly with automated systems to deliver comprehensive solutions.

Managing Subscription Plans and Changes

Handling subscription changes with ease is a hallmark of effective workflows. Custom workflows are particularly adept at managing the complexities that arise when customers need to adjust their plans, pause subscriptions, or take advantage of promotions.

Proration simplifies subscription adjustments. For example, if a customer upgrades from a $50 monthly plan to a $100 plan halfway through the cycle, the workflow automatically calculates the prorated amount and adjusts the next billing date. This eliminates manual calculations, reducing errors and avoiding confusion.

Trial period flexibility is another strength of custom workflows. They can accommodate varied trial structures, such as offering a 7-day free trial followed by a discounted rate before transitioning to full pricing. This adaptability enhances the customer experience and makes onboarding smoother.

Timing for plan changes is managed with precision. Whether customers want changes to take effect immediately, at the next billing cycle, or on a specific date, custom workflows provide the flexibility to meet those needs. This reduces friction and makes the process more customer-friendly.

Automated Invoicing and Payment Processing

Automation in invoicing goes beyond simply generating bills - it ensures accuracy, transparency, and efficiency in even the most complex billing scenarios.

Dynamic invoice generation is a standout feature. For instance, a SaaS company offering seat-based pricing alongside usage-based add-ons can produce invoices that clearly break down fixed subscription fees, variable charges, and any applied discounts or credits. This level of detail builds trust and keeps customers informed.

Payment retry logic minimizes the need for manual intervention. For example, the workflow might retry a failed payment after 3 days, then again after 7 and 14 days. This systematic approach reduces revenue loss without requiring constant oversight.

Customer communication sequences are tightly integrated with payment processing. When an invoice is created, the workflow can automatically send a notification email. If a payment fails, a tailored email sequence is triggered, focusing on resolving the issue. These communications are personalized based on the customer's subscription history, making them more effective and engaging.

Failed Payment Recovery and Customer Retention

Custom workflows shine in the area of failed payment recovery, employing sophisticated strategies to secure revenue and retain customers. These workflows go beyond basic retries, creating comprehensive recovery plans.

Intelligent dunning management uses a multi-step approach to recover failed payments. It might start with a friendly email reminder, escalate to SMS notifications, and eventually involve phone calls from the customer success team. Each step is carefully timed to maximize recovery while maintaining a positive relationship with the customer.

Payment method updates are seamlessly integrated into the recovery process. For example, if a payment fails due to an expired card, the workflow automatically sends a secure link for the customer to update their payment information. Additionally, it can integrate with services that update expired card details automatically, reducing friction for the customer.

Retention-focused communications set advanced workflows apart. Instead of merely requesting payment, these workflows might offer solutions like temporary discounts, payment plans, or even subscription pauses. For instance, a customer experiencing financial difficulties might be given the option to pause their subscription for 30 days instead of canceling outright.

The success of these strategies often lies in their level of personalization. Custom workflows can segment customers based on factors like subscription value, payment history, and engagement. High-value customers might receive immediate personal follow-ups, while newer customers are guided through automated recovery steps. This tailored approach ensures every stage of the billing process - from subscription management to payment recovery - supports customer retention and revenue growth.

Selecting Payment Providers for SaaS Workflows

Custom payment workflows depend on providers that offer automated, scalable solutions for recurring billing. Picking the right payment provider is essential to seamlessly integrate these workflows into your SaaS operations. The ideal provider should handle billing automation, manage failed payments, and grow alongside your revenue. With so many options out there, each with its own features and limitations, making the right choice requires a careful evaluation of your business needs and how they align with what each provider offers.

Payment Provider Evaluation Criteria

When narrowing down your options, there are several key factors to consider:

API flexibility and developer tools are critical. Your custom workflows will rely heavily on how well you can integrate with the provider’s system. Providers offering strong APIs, detailed documentation, and webhook support stand out. Features like programmatic subscription management, proration handling, and billing adjustments are essential for advanced workflows.

Recurring billing capabilities differ widely among providers. While some handle basic monthly subscriptions well, they may struggle with more complex setups like usage-based billing or mid-cycle changes. Look for support for tiered pricing, seat-based models, and automated plan adjustments to avoid manual interventions.

Failed payment recovery mechanisms are another crucial consideration. Building custom retry logic is an option, but providers with built-in tools for handling failed payments can save you time and improve recovery rates. Features like automatic card updates, retry schedules, and options to pause rather than cancel subscriptions can make a big difference.

Global payment method support becomes essential as you expand internationally. While credit card processing may work initially, you’ll likely need to support ACH transfers, digital wallets, and local payment methods in your target markets. Ensure the provider can handle currency conversion and accommodate regional payment preferences.

Pricing structure and scalability directly affect your bottom line. Transparent pricing models and volume discounts can have a significant impact as you grow. For instance, transaction fees ranging from 2.9% + $0.30 to 5% + $0.50 can lead to substantial cost differences. Evaluate how fees scale with your revenue and whether discounts are available.

Compliance and security are non-negotiable. The provider should meet PCI DSS Level 1 standards, offer strong customer authentication (SCA) for European users, and provide enterprise-grade security features. Some providers also simplify compliance by handling sales tax calculations and remittance.

Integration ecosystem and marketplace support can streamline your workflow setup. Providers with pre-built integrations for tools like accounting software, CRM platforms, and analytics systems reduce implementation headaches. If you’re planning to operate a multi-vendor marketplace, check for specific support for that model.

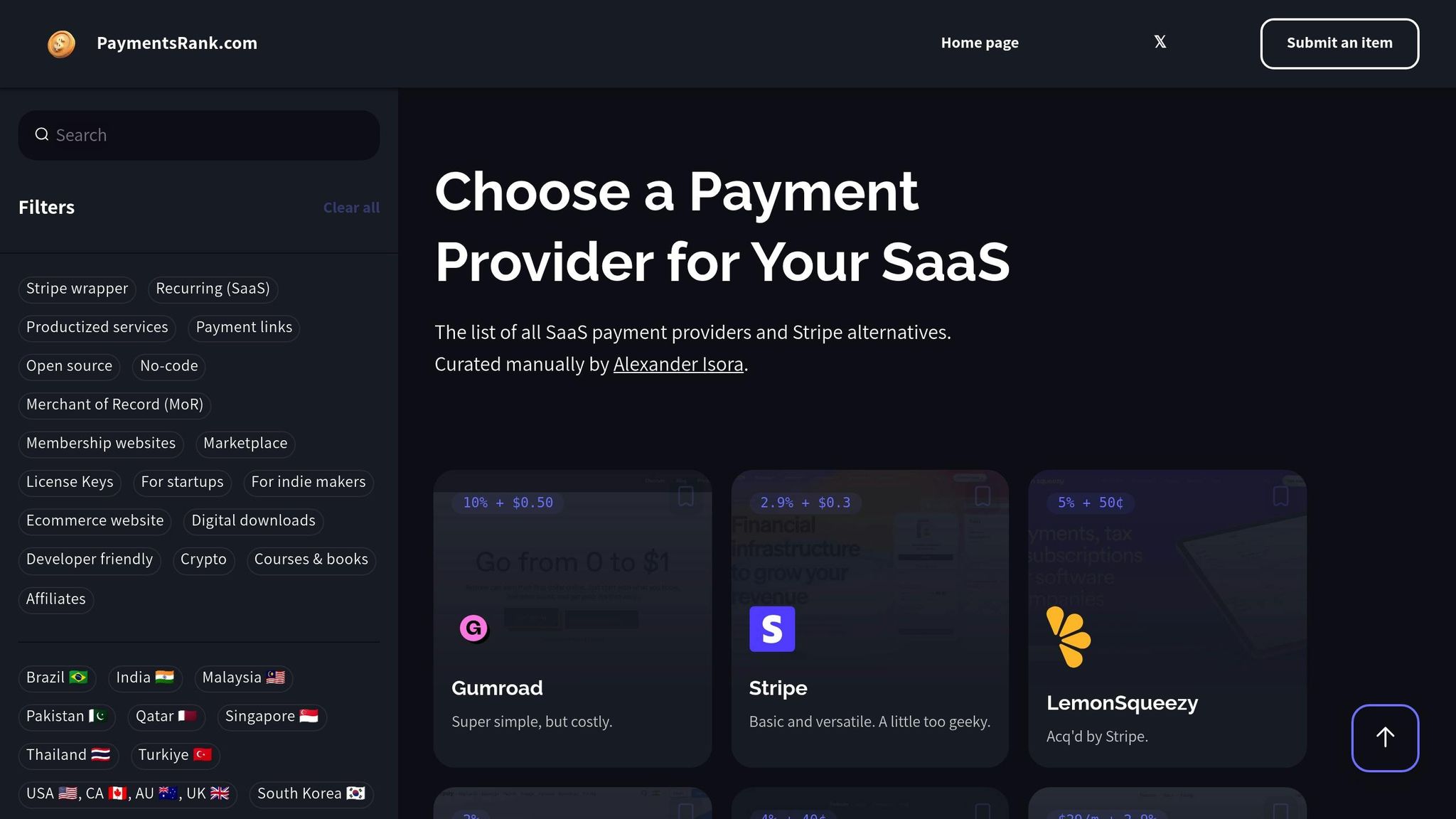

Using Choose a Payment Provider for Your SaaS

To simplify the selection process, Choose a Payment Provider for Your SaaS (https://paymentsrank.com) offers a curated comparison of payment providers tailored specifically for SaaS businesses. This platform organizes providers into clear categories, breaking down their features and pricing to make comparisons easier.

The platform’s filtering system lets you refine your search based on your specific needs. Whether you’re looking for robust APIs, recurring billing support, no-code solutions, or features for unique business models like memberships or marketplaces, the filters help you quickly identify suitable options.

Detailed provider profiles go beyond surface-level comparisons. They include insights into API quality, global payment support, and features designed for SaaS workflows. These in-depth profiles help you find a provider that aligns with your technical and operational requirements, ensuring your workflows can handle complex billing scenarios.

The platform also accounts for regional considerations, highlighting providers that specialize in specific markets. For example, some focus on India, while others excel in European payment methods. For U.S.-based SaaS companies eyeing international growth, these insights can help you avoid costly migrations down the line.

Transparent pricing information is another standout feature. The platform breaks down transaction fees, monthly costs, and additional charges, helping you model the financial impact of different providers as your revenue grows. This clarity makes it easier to plan and manage your costs effectively.

Finally, the platform offers educational resources to help you understand the payment processing landscape. These resources explain why certain features matter for SaaS workflows, giving you the knowledge to make confident, informed decisions. By combining practical comparisons with valuable context, the platform is especially useful for SaaS founders navigating the complexities of payment provider selection.

sbb-itb-a989baf

Implementation Best Practices for Custom Workflows

Getting custom workflows right can take your billing processes from a source of frustration to a streamlined system that drives growth. With careful planning and smart integration, you can build workflows that handle a variety of billing scenarios while syncing seamlessly with your existing tools. The goal? To simplify recurring billing and turn it into a competitive edge.

Setting Up Workflow Rules for Different Billing Scenarios

Subscription renewal workflows are the backbone of any recurring billing system. Set rules that automatically process renewals 24 to 48 hours before the billing date. This buffer allows time to address any payment issues. Tailor your approach based on subscription tiers: enterprise clients might get personalized renewal notifications, while standard users receive automated emails summarizing usage and confirming renewals.

Plan change workflows should manage both upgrades and downgrades smoothly. For mid-cycle upgrades, use proration logic to adjust charges accurately. Downgrades are often applied at the start of the next billing cycle to avoid refund complications.

Cancellation workflows should balance retention efforts with respect for customer decisions. Include features like pause options and targeted retention offers based on why customers choose to cancel.

Failed payment workflows can reduce churn by using smart retry logic. Schedule retries at intervals such as immediately, 3 days, 7 days, and 14 days, while excluding permanent failure codes to avoid unnecessary retries.

Usage-based billing workflows require real-time monitoring and alerts. Notify customers as they approach usage limits and suggest plan upgrades to avoid service interruptions.

Seasonal billing adjustments are perfect for businesses with fluctuating needs. For example, educational software providers might offer summer pause options for school-based customers. Automate these adjustments to align billing cycles with periods of high or low usage.

Integrating these workflows with external systems ensures smoother operations and compliance with regulations.

Connecting Workflows with Accounting and Compliance Tools

Beyond setting up billing rules, integrating workflows with accounting and compliance tools strengthens your payment system and ensures accuracy.

Revenue recognition integration is essential for aligning payment workflows with accounting standards. By connecting to platforms like NetSuite or QuickBooks, you can automate journal entries for processed payments. For subscriptions, this means spreading revenue across service periods instead of recognizing it all upfront. For example, annual subscriptions might generate deferred revenue entries that are recognized monthly.

Tax compliance automation becomes increasingly important as your business grows. Link workflows with tax calculation tools to handle rates based on customer location and service type. These workflows should also manage tax exemption certificates, flagging exempt customers and storing the necessary documentation. When tax rates change, automated updates ensure future invoices are accurate without manual adjustments.

Audit trail creation ensures transparency. Every action within your workflows - whether it's a payment attempt, a plan change, or a refund - should generate a timestamped record. These logs should include details like the workflow rule that triggered the action, customer data used, and any manual overrides. Such records support both internal reviews and external audits.

Financial reporting automation connects workflows to your business intelligence systems. Automate reports to track metrics like monthly recurring revenue (MRR), churn rates, and payment failures. Real-time data from your workflows ensures accurate forecasting and performance monitoring.

Compliance monitoring workflows help you meet regulations like PCI DSS and GDPR. Automate checks to verify how customer data is handled and flag any compliance issues. For international customers, workflows should respect data residency rules and provide easy access to personal data upon request.

Multi-currency accounting integration is crucial for businesses handling international payments. Workflows should record both the original currency amount and the converted amount, along with the exchange rate used. This dual recording simplifies financial reporting and tracks foreign exchange gains or losses.

Dunning management integration connects failed payment workflows with customer communication tools. Instead of sending generic failure notifications, personalize messages based on customer history, subscription value, or past payment behavior. For high-value accounts, consider phone calls, while smaller accounts might receive email sequences with self-service payment update options.

Reconciliation workflows match payments received with issued invoices, flagging discrepancies for manual review. This is especially useful for enterprise clients who might pay multiple invoices with a single wire transfer or apply credits from previous overpayments. Automating these workflows ensures accuracy in even the most complex scenarios.

Key Takeaways for SaaS Payment Workflows

Custom payment workflows can transform recurring billing challenges into opportunities for growth. By automating processes, reducing errors, and freeing up resources, businesses can focus on more impactful activities.

A well-rounded billing system that handles everything from simple subscriptions to more intricate usage-based pricing reduces the need for manual intervention. It can adapt to changes like failed payments, seasonal fluctuations, and enterprise-level customizations. This adaptability not only simplifies operations but also brings measurable financial advantages.

Carefully designed workflows directly improve financial outcomes. They recover failed payments, ensure accurate revenue recognition with prorated billing, and automate tax compliance - especially important when expanding internationally.

Choosing the right technology partners is key. As mentioned earlier, providers with strong API documentation, flexible webhook systems, and robust billing features are essential for building efficient workflows. When evaluating potential providers, focus on how well their automation and integration capabilities fit your business model. This choice impacts everything from development time to long-term maintenance costs.

For businesses ready to implement custom workflows, resources like Choose a Payment Provider for Your SaaS can help. This site provides detailed comparisons of payment providers, including filters for recurring billing features, developer support, and pricing models, making it easier to find a provider that matches your business needs.

Seamless integration with tools like accounting software, customer support platforms, and business intelligence systems is critical. These integrations ensure smooth data flow, accurate financial reporting, and better customer success initiatives across your organization.

When billing is treated as a product feature, it can enhance customer satisfaction and retention. A smooth, transparent, and flexible billing experience leaves a positive impression on customers, while poor billing practices can quickly erode trust.

Optimization is an ongoing process. As your business grows and customer expectations shift, your payment workflows should evolve too. Regularly tracking key metrics such as payment success rates and customer feedback ensures continuous improvement and highlights the strategic value of your payment systems.

FAQs

How can custom payment workflows help SaaS businesses reduce customer churn?

Custom payment workflows play a key role in keeping customers around by making billing smoother and more dependable. Automating tasks like retrying failed payments helps recover revenue that might otherwise slip through the cracks due to involuntary churn. On top of that, these workflows can send helpful reminders about upcoming payments or subscription renewals, ensuring customers stay informed and avoid disruptions.

They also offer flexibility, letting customers easily pause or downgrade their subscriptions when needed. This not only boosts satisfaction but also encourages customers to stick around longer. By solving common billing frustrations, custom workflows help SaaS businesses earn trust and build lasting loyalty with their customers.

What should I look for in a payment provider to ensure smooth integration with custom recurring billing workflows?

When selecting a payment provider for managing custom recurring billing workflows, it's essential to prioritize features that streamline operations and ensure dependability. Payment automation plays a key role here, as it simplifies recurring transactions, reduces manual effort, and minimizes errors. It's equally important to choose a provider that integrates smoothly with your current systems, ensuring accurate financial reporting and uninterrupted data flow.

Another critical aspect to consider is customization. A platform that lets you adapt workflows to match your specific requirements can make a world of difference. Support for various payment methods, such as credit cards and ACH transfers, is also a must-have to cater to diverse customer preferences. On top of that, features like dunning management - which automates payment reminders and retries - can help reduce involuntary churn and keep your revenue steady. Together, these capabilities can create a streamlined and effective billing process tailored to your SaaS business needs.

How do custom payment workflows improve the customer experience when updating subscription plans?

Custom payment workflows simplify the process for customers to update or modify their subscription plans by offering a range of billing options. These workflows can manage different pricing structures, such as flat fees, tiered pricing, or usage-based models. They also incorporate features like prorated charges, free trials, and discounts without any hiccups.

On top of that, automation tools integrated into these workflows ensure smooth transitions when plans are changed. They handle billing adjustments efficiently, minimize errors, and enhance revenue collection with smart retry systems. This makes the entire experience seamless for both businesses and their customers.